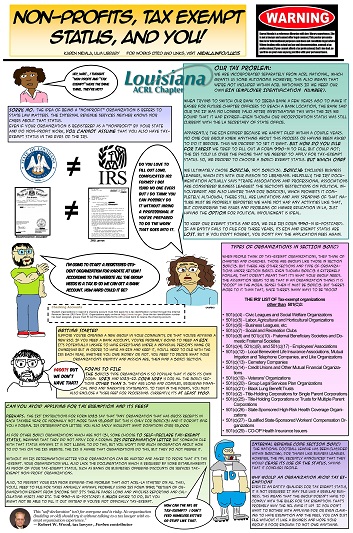

Non-profits, Tax Exempt Status, and You!

Poster Presentation at the 2015 LOUIS Users Conference

Baton Rouge, LA, Oct. 7-8

Are you thinking of starting a non-profit? Are you sure your organization's status is valid? How do you file? What code section is right for you? Taxes are boring but important to think about! There are different types of non-profit organizations and different code sections for each, but tax exempt status isn't automatic. This poster will detail ACRL-LA's decision to change its tax exempt status section under Internal Revenue Code section 501(c), the process to apply for exemption, Louisiana State and Federal forms to file, and other considerations involved with non-profits and tax exemption.